Money

Economics on the Internet: The Long Tail

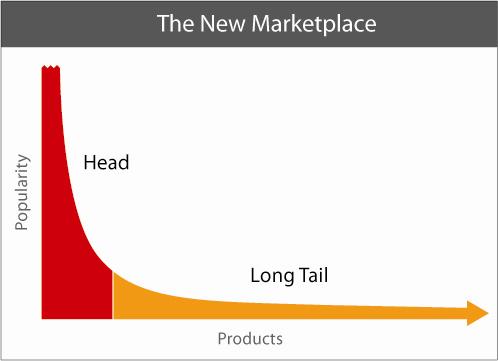

Part IV of the book includes one essay, "The Long Tail" by Chris Anderson (2004), which originally appeared in Wired magazine. Anderson (2012) argued that the Long Tail "is an example of an entirely new economic model for the media and entertainment industries, one that is just beginning to show its power" (p. 137). In "What is the Long Tail?" Anderson, using examples from online media retailers such as Amazon.com, showed how online consumers are able to search for lesser-known titles and purchase them in a manner not possible in a physical store because of several factors, including the lack of need to sell to local audiences, the ability to inventory more titles digitally, and the "constraint of . . . physics itself. The radio spectrum can carry only so many stations, and a coaxial cable so many TV channels" (p. 139). Online companies offer limitless selection and choice, and the purchase of obscure media titles made up the "anatomy of the long tail" on a sales graph (p. 139): The number of lesser-known titles purchased may be less per title, but ultimately make up a section of titles sold that stretches wide across the total number of sales, encompassing a chunk of sales to a market not possible in a physical store. Anderson argued that Long Tail economics are the opposite of hit-driven economics, where there simply was not enough space to sell everything to everybody. Now, online, there is.

Anderson argued that there are "three big lessons" of the Long Tail (p. 143). The first is "Make Everything Available . . . almost anything is worth offering on the off chance it will find a buyer. This is the opposite of the way the entertainment industry now thinks" (p. 144). Rule 2 is "Cut the Price in Half, Now Lower It" (p. 145). Without the overhead of a traditional retail operation, online distribution can charge much less, so much less that it is arguable that free (underwritten by advertising or flat usage fees) may be the best price in the Long Tail (p. 148). Finally, Rule 3 is "Help Me Find It," or the powerful Long Tail attribute of recommendation engines. Anderson used the example of Rhapsody.com to show how finding similar music tracks helps consumers locate what they want to listen to, and as a result of that help, earns their loyalty (p. 149). As Anderson argued, "That is the difference between push and pull, between broadcast and personalized taste. Long Tail business can treat consumers as individuals, offering mass customization as an alternative to mass-market fare" (p. 150). Anderson's analysis aids the reader in understanding the demise of the mall bookseller or the Blockbuster Video store, and the overwhelming success of companies such as Amazon.com.

While Anderson's work is critical to an understanding of the economics of the Internet, the "Money" section could have gone further. It presents but one concept, Anderson's Long Tail, and leaves to future scholarship the myriad of other issues involving currency in social media, including social gaming applications.